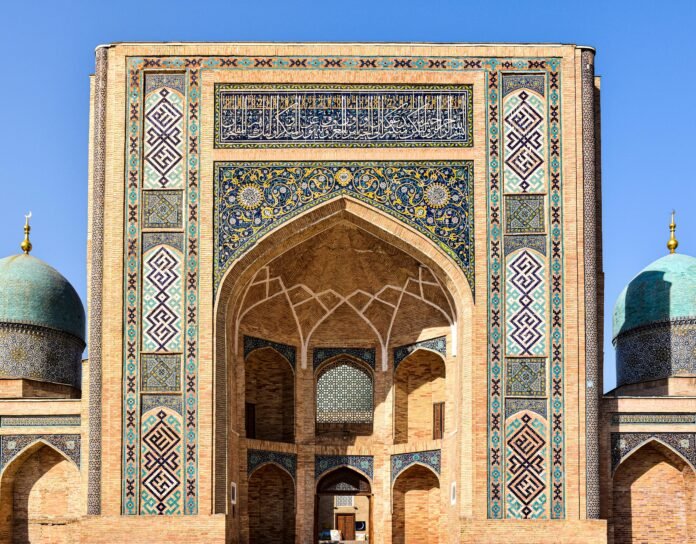

Studying abroad is exciting. You are wading into a new culture, another language and a completely exotic system. Uzbekistan is a country with its own history, strategically situated at the heart of Central Asia, and it is becoming more and more appealing to the international students. However, one problem of it is also one of vital challenge: health insurance.

As an international student, you should not forget about your health coverage in case you are planning to study in Uzbekistan. Compared to the Western countries where insurance markets are widely represented, Uzbekistan does not have many local insurance companies of foreign students. It implies that the majority of international students use health insurance companies worldwide, or, to put it differently, companies that provide specific student packages covering not only health care in hospitals, but also mental health care and repatriation.

The guide will show the Top 10 health insurance plans available to international students in Uzbekistan, their specifications, benefits, and practical recommendations on how to select the correct one. This blog will clarify things whether you are applying to a one year course in language in Tashkent or a full degree course in Samarkand.

🎯 Why You Need International Health Insurance in Uzbekistan

Before we plunge in the list, it is important to consider the big question, which is why we even need health insurance in Uzbekistan?

Here’s the truth. The healthcare system of Uzbekistan is being modernized but infra-structural constraints continue to be a problem, especially to the non citizens. Most clinics and hospitals are not accepting of foreign insurance cards and credit card. Medical staff that speaks English might not be there at all times. And the private medical clinics, most expats and international students favor the facilities, demand an upfront fee.

In the absence of a valid international student insurance plan, you might have to postpone your treatment, pay more than necessary in receiving basic services, or even the worst scenario of flying back home to receive treatment. That explains why world covers with Uzbek coverage are necessary.

🌍 Top 10 Health Insurance Providers for International Students in Uzbekistan

1. IMG Global (Student Journey & Student Health Advantage)

- What makes it great: IMG is an industry leader in international student insurance, and its plans are accepted across universities globally.

- Plan features:

- Options: Lite, Plus, and Platinum

- Coverage up to $500,000

- 24/7 telehealth access

- Strong mental health benefits

- Options: Lite, Plus, and Platinum

- Best suited for: Students looking for tiered, flexible coverage with a solid global support system.

From emergencies to ongoing therapy, IMG provides comprehensive coverage tailored to academic schedules and student budgets.

2. International Student Insurance (ISI)

- What makes it great: ISI focuses solely on student needs and offers visa-compliant, cost-effective options.

- Plan features:

- Mental health, maternity, sports injury coverage

- Low deductibles and co-payments

- Designed for university compliance and visa requirements

- Mental health, maternity, sports injury coverage

- Best suited for: Students seeking well-rounded protection without breaking the bank.

ISI is popular among educational agencies and student exchange programs for good reason—it delivers consistent service at student-friendly rates.

3. April International

- What makes it great: A digital-first insurer serving over 500,000 international students.

- Plan features:

- Civil liability and repatriation included

- Multilingual support

- Online claims and mobile access

- Civil liability and repatriation included

- Best suited for: Students who value tech-savvy insurance with legal and civil protections.

Its second medical opinion service and paperless admin system make April a go-to for modern students.

4. Cigna Global

- What makes it great: It’s one of the most customizable insurers out there, perfect for students with specific medical needs.

- Plan features:

- Modular plans: add dental, vision, outpatient, and more

- Flexible deductibles and copays

- Worldwide coverage with multilingual support

- Modular plans: add dental, vision, outpatient, and more

- Best suited for: Students who want to tailor their plan precisely.

Planning to stay more than a year or with a family? Cigna gives you options to grow and adapt your coverage.

5. Allianz Care

- What makes it great: A trusted global brand, with excellent customer service and university recognition.

- Plan features:

- Multilingual helpline, 24/7

- Fast claim reimbursements

- Dental, maternity, and evacuation add-ons

- Multilingual helpline, 24/7

- Best suited for: Students who want reliability and strong institutional support.

With excellent hospital networks and telehealth options, Allianz offers a strong sense of security.

6. Seven Corners (Liaison Student Series)

- What makes it great: Its student plans are comprehensive, yet affordable, with standout emergency coverage.

- Plan features:

- Coverage for prescriptions, physician visits, and hospital stays

- Emergency evacuation and repatriation

- Strong support for students outside the U.S.

- Coverage for prescriptions, physician visits, and hospital stays

- Best suited for: Students who want dependable medical access during unexpected situations.

Seven Corners’ customizable plans let you strike the right balance between budget and protection.

7. Insubuy

- What makes it great: It’s both a marketplace and advisor, helping you compare plans from leading insurers.

- Plan features:

- Options like ExchangeGuard, which meet most academic requirements

- Detailed comparisons of coverage, limits, and pricing

- Transparent reviews and customer feedback

- Options like ExchangeGuard, which meet most academic requirements

- Best suited for: Students who want to explore several providers and get the best value for money.

Insubuy’s educational content helps you avoid rookie mistakes in choosing a policy.

8. PSI Service

- What makes it great: Focused on international students, PSI offers simple, quick, and affordable plans.

- Plan features:

- Online sign-up in minutes

- 24/7 claim support

- Low-cost plans with decent outpatient care

- Online sign-up in minutes

- Best suited for: Students who need basic coverage on a tight budget.

It’s ideal for short-term language students or gap-year learners who still want some security.

9. International-sante.com

- What makes it great: A France-based provider offering EU-compliant, budget-friendly student plans.

- Plan features:

- Plans start at €33/month

- Repatriation, civil liability, and hospital coverage

- Instant policy documents on payment

- Plans start at €33/month

- Best suited for: EU students or price-sensitive students looking for visa-friendly options.

For students who want peace of mind without extra frills, this is a great place to start.

10. Expert Education Student Health

- What makes it great: Tailored to Eurasian markets, this is a specialized option often overlooked.

- Plan features:

- Designed for students studying in Central Asia, including Uzbekistan

- Pre-existing condition disclosure supported

- High policy durability and portability

- Designed for students studying in Central Asia, including Uzbekistan

- Best suited for: Students with unique needs or those transferring between institutions in the region.

It’s especially useful if you’re part of a long-term regional exchange or partnership program.

🧠 Must-Have Policy Features: What to Look For

Before purchasing any policy, check that it includes the following:

| Coverage Area | Why It Matters |

| Emergency hospitalization | Avoids massive costs in life-threatening cases |

| Doctor consultations | Covers flu, infections, routine health checkups |

| Telemedicine | Lets you speak to doctors online without visiting a clinic |

| Mental health | Crucial for managing stress, homesickness, and anxiety |

| Prescription medications | Pays for drugs and treatments after doctor visits |

| Repatriation | Covers cost of returning home due to severe illness or death |

| Civil liability | Protects you if you accidentally injure someone or cause damage |

| Maternity (if applicable) | Critical for long-term students or married students |

Every policy will differ in the limits, waiting periods, and exclusions, so read the documents carefully.

📝 How to Choose the Right Plan: 5 Key Steps

1. Ask your university if they have preferred providers

Some Uzbek universities may have partnerships or list accepted insurers. It’s easier to go with a pre-approved plan than challenge the system later.

2. Compare prices and coverage side by side

Don’t just look at the monthly premium. Check the total coverage limit, exclusions, and claim process.

3. Consider how long you’ll stay

Short-term exchange? Basic plans work. Full degree program? Invest in better coverage with annual renewal options.

4. Plan for mental health

Even if you think you won’t need it, mental health coverage is essential. Living abroad comes with emotional ups and downs.

5. Go digital

Choose a provider that offers:

- Online enrollment

- Instant certificates

- Mobile app or web claim submission

This reduces hassle and speeds up approvals when you’re stressed or sick.

🧾 Quick Comparison Table

| Provider | Best Feature | Ideal For |

| IMG Global | Tiered plans + telehealth | Students needing mental health too |

| International Student Insurance (ISI) | Visa-compliant + comprehensive | First-time students |

| April International | Legal and civil coverage | Shared-housing or mobile students |

| Cigna Global | Fully modular customization | Long-term or family students |

| Allianz Care | Global trust + rapid processing | Risk-averse, cautious students |

| Seven Corners | Excellent emergency services | Active, traveling students |

| Insubuy | Compare plans easily | Budget-conscious, research-driven |

| PSI Service | Fast, online, and simple | Language program students |

| International-sante.com | Budget EU options | EU students in Uzbekistan |

| Expert Education Student Health | Designed for Central Asia | Regional program students |

Pro Tips:

The Uzbekistan study is an opportunity in itself. The hidden gem of the world education is the language, culture, and strategic location. However, there is no way that you can completely enjoy the experience when you are worrying of what is going to happen when you fall sick.

So do not put your money on health. Put money on a program of a trustworthy international organization that is knowledgeable about the special requirements of students. Among the ten providers mentioned above they are not mere safe bets but lifelines.

Since the Silk Road might be passing by Uzbekistan, your student adventure must be paved by the assurances that you are safe, confident, and supported.

References:

- Allianz Care. (2024). Student Health Plans. https://www.allianzcare.com/en/student-health-insurance.html

- April International. (2024). International Student Insurance Plans. https://www.april-international.com/en/student

- Cigna Global. (2024). International Student Health Insurance. https://www.cignaglobal.com/health-insurance/student

- HCCMIS (Tokio Marine). (2024). StudentSecure Insurance Plans. https://www.hccmis.com/student-health-insurance/studentsecure/

- IMG Global. (2024). Student Journey Health Insurance. https://www.imglobal.com/img-insurance-plans/student-health-insurance

- Insubuy. (2024). ExchangeGuard and Student Plans Comparison. https://www.insubuy.com/student-health-insurance/

- International Student Insurance. (2024). Compare Plans for Students. https://www.internationalstudentinsurance.com/student-health-insurance/

- International-Sante.com. (2024). Assurance Santé pour Étudiants Internationaux. https://www.international-sante.com

- PSI Services. (2024). Student Insurance. https://www.psiservice.com

- Seven Corners. (2024). Liaison Student Insurance. https://www.sevencorners.com/plans/liaison-student