The Community-Based Health Insurance (CBHI) program, also known as Mutuelle de Santé, which is mandated for all residents, including the growing population of international students, is at the heart of Rwanda’s healthcare resilience and institutional reform. Since its introduction in 2004, the Mutuelle de Santé has expanded to cover nearly 86% of the population, decentralizing healthcare services through 1,280 health posts and 520 health centers. For an international family, the public infrastructure is far more than a safety net, it is a required administrative step for long-term residency and an initial entry point for national healthcare services.

As with many public systems, Rwanda’s Mutuelle de Santé has a tiered structure, supported by the Ubudehe classification, where households are classified based on their assets and income levels. While the poorest citizens receive completely free healthcare services, middle-class citizens, typically international students and foreign professionals, pay an approximate premium of RWF 7,000 annually ($10 USD). Although the Mutuelle de Santé has successfully reduced infant mortality rates by over 60%, there are several structural sustainability challenges facing the system. Historically, the system has consistently experienced significant gaps in funding, such as the 17,670 million RWF deficit recorded during the 2017-2018 fiscal year, largely due to the system’s dependency upon external donor assistance and government funding. To address these concerns, the Ministry of Health developed the Fifth Health Sector Strategic Plan (HSSP V), which outlines a projected budget of up to $4.9 billion USD from 2030 to improve the quality of services provided while improving the financial equity throughout the system.

While the public Mutuelle de Santé program provides the international student family with affordable options for common endemic diseases such as malaria and basic respiratory illnesses, it was created for providing basic and secondary levels of care. More complex tertiary interventions such as advanced oncology treatments, complex cardiac surgeries and neonatal intensive care, will frequently need to be accessed via private or public-private referral centers in Kigali. Additionally, while diagnostic testing equipment such as MRI and CT scanners can be found at some decentralized health centers, they are not equally distributed throughout the network, resulting in a practical necessity for additional supplemental private international medical insurance (IPMI) to facilitate access to the elite tier of both Rwandan and regional healthcare providers.

Institutional Requirements and the Academic Health Mandate

Universities such as University of Rwanda (UR), the University of Lay Adventists of Kigali (UNILAK) have in place some form of health insurance or mandatory fees to reduce the risk of health-related crisis affecting a student.

All international students at UNILAK pay a mandatory annual health insurance premium of $80 USD, typically included as part of the registration requirements, and provides a student with basic clinical services at one of the university’s on-campus clinics, or at a designated partner facility. An evaluation of the adequacy of plans developed and operated by universities shows there is a large “Family Coverage Gap”. Most institutional plans are designed solely around the needs of the individual student and do not provide for the inclusion of spouse or dependent(s).

When a child of an international student requires hospitalization due to illness, the $80 institutional premium will provide no financial assistance and the family will be left to rely on its own private arrangements or the local Mutuelle scheme.

In contrast, UR’s Medical Insurance Scheme (MIS/UR) has been developing over 15 years to provide both national and international coverage to UR employees and students alike. In addition, UR uses a digital “Student Medical Access Document”, providing students with access to care at any of the country’s approved treatment facilities. While the MIS/UR program has many benefits to students and their families, there still exists the exposure to the increasing costs of private specialized care, should the student and/or his/her family fail to purchase a top-up international plan.

Comparison of Institutional Health Fees and Access

| Institution | Mandatory Fee (USD) | Coverage Scope | Dependent Inclusion |

| UNILAK | $80 / year | Basic local/on-campus 8 | No 10 |

| MIS/UR | Varies by year | National referral network 9 | Limited co-payment 9 |

| ALU | Part of tuition | Internal/Private options 14 | No 11 |

Deep Dive: 10 Essential Insurance Options for Student Families

Given the absence of a unified “International Student Family” local product, families must navigate a selection of global and regional insurers. The following ten options represent the most utilized frameworks for combining local compliance with international-standard medical security.

1. Cigna Global: Modular Flexibility and 2026 Rate Adjustments

Cigna Global stands as a market leader for families who prioritize flexibility. Their modular approach allows families to build a plan starting with “International Medical Insurance” (Inpatient) and adding modules for “Outpatient,” “Health & Wellbeing,” or “Vision & Dental”.

A pivotal development for 2026 is Cigna’s 25% decrease in international premiums for certain employee and family tiers, significantly increasing the value proposition for long-term student residents. For a family of four, the 2026 Cigna family medical rate is projected at $1,546.63 per year, a sharp reduction from the 2025 premium of $2,059.24.

The “Silver” plan remains the entry point for many families, providing up to $1,000,000 in annual benefits, including full cancer care and private hospital rooms. However, families must note that maternity is entirely excluded from the Silver tier; the “Gold” plan (up to $2,000,000) or “Platinum” plan (unlimited) is required for those planning to expand their family, carrying a strict 12-month waiting period.

2. Allianz Care: Digital Health Integration for the EAC

Allianz Care has strategically updated its “Care” plans as of late 2025 to offer a simplified customer experience. These plans, categorized as Base, Enhanced, and Signature, are tailored for expatriates and students spending 12 months or more abroad.

Allianz’s “Care Enhanced” plan is particularly suited for families, as it includes maternity and bariatric surgery as standard offerings, though subject to 12-month and 24-month waiting periods, respectively. One of the primary drivers for Allianz’s popularity in Rwanda is its massive global network of 2 million providers and its commitment to processing claims within 48 hours via the “My Health” app. Monthly premium ranges for the Base tier start at approximately £110, but families should be wary of the 5% surcharge for monthly payments.

3. Zamara International Private Medical Insurance: Regional Expertise

Zamara Rwanda offers a nuanced regional product that is often more accessible to those who do not require full “Worldwide” coverage that includes the high-cost USA market. Their International Private Medical Insurance (IPMI) provides flexibility in choosing doctors anywhere within their specific “region of cover,” which heavily favors the East African Community (EAC).

For families, Zamara’s “Zamara Afya” policy offers an affordable entry point, providing prompt access to healthcare and expertise without the exorbitant premiums of purely global insurers. A significant insight for students is that Zamara often waives waiting periods and pre-entry medical examinations for certain group-affiliated members, a benefit that can sometimes be accessed through university partnerships or scholarship organizations.

4. Prime Insurance: The ISONGA Plan and EAC Portability

Prime Insurance Rwanda offers the “ISONGA” plan, which is perhaps the most tailored domestic-regional hybrid for Rwandan residents. This plan is unique because it explicitly covers medical services within the EAC territory, including Kenya, Uganda, and Tanzania, and allows for referrals to India on a pre-authorized basis.

| ISONGA Plan Feature | Detail and Limitation |

| Inpatient Limit | RWF X,XXX,XXX per family |

| Maternity | 10-month waiting period |

| Pediatrics | Vaccinations up to 1.5 years included |

| Chronic Conditions | 1-year waiting period |

The ISONGA plan utilizes a 10% deductible (co-pay) for outpatient claims but offers 100% coverage for pre-authorized inpatient treatment. This balance makes it an excellent “top-up” for students who find the $80 university insurance insufficient for family hospitalizations.

5. International Medical Group (IMG): Budget-Focused Student Protection

IMG is widely recognized as the go-to provider for younger clients and students on a budget. Their “Student Health Advantage” (SHA) and “SHA Platinum” plans are designed to meet university and visa requirements, providing up to $1,000,000 in coverage for the student.

The IMG dependent coverage model is slightly more restrictive than full expat plans, often capping dependent benefits at $100,000. For a student family in Rwanda, where healthcare costs are moderate compared to the US, a $100,000 limit for a spouse or child may be acceptable, especially given the competitive monthly premiums that can start as low as $31.However, the 12-month waiting period for pre-existing conditions and 10-month waiting period for maternity must be factored into the family’s long-term residency plan.

6. APRIL International: The “Expat Student” Specialist

APRIL International offers the “Expat Student” policy, a long-term study-abroad solution that covers stays of 1 to 6 years. This plan is notably flexible, allowing students between the ages of 12 and 40 to add their spouse and children under certain conditions.

Starting at approximately €57 per month, the APRIL plan provides 100% coverage for medical costs with no deductible or waiting period for standard illnesses. This “first-dollar” coverage approach is highly valued by families who want to avoid the administrative hassle of managing small co-pays at local clinics. Their “Easy Claim” app is among the highest-rated in the industry, enabling paperless reimbursements within days.

7. Auras Student Travel Insurance: Bridging the Outbound Gap

Auras Insure focuses on the specific needs of students moving from Rwanda to destinations like the USA, UK, and Australia. While not a long-term family medical solution for residents in Rwanda, it is a vital tool for the family of a Rwandan student studying abroad.

Their plans are embassy-compliant and provide essential medical care, including COVID-19 treatment and emergency dental. For a family left behind in Rwanda while the student is abroad, Auras provides the necessary coverage to satisfy visa requirements, while the family remains covered under a local Prime or Zamara plan.

8. Local University-Arranged Schemes (The “MIS/UR” Model)

While institutional plans like the MIS/UR at the University of Rwanda or the mandatory $80 fee at UNILAK are often seen as “basic,” they provide a critical “Member Network” in Rwanda. These plans allow students to access the three national referral hospitals (KFH, CHUK, and CHUB) through an established billing pipeline.

The primary drawback for families is the lack of “Lodger Fees” or “Adult Companion” accommodation in many of these local plans. If a child is hospitalized, international plans like VUMI or Allianz often pay for a parent to stay in the room ($150–$350 per night), whereas local university plans often expect the family to cover these “non-medical” costs.

9. Mutuelle de Santé + Top-Up (The Hybrid Strategic Model)

For the most cost-sensitive families, the hybrid approach is undeniably the most efficient. This involves enrolling the entire family in Mutuelle de Santé for $10/year per person to handle primary care and community clinic visits.

The family then “tops up” with a high-deductible international plan like AXA Foundation or Now Health SimpleCare CORE. By choosing a $2,500 or $5,000 deductible, the family pays a minimal premium for the international plan, using it only for catastrophic events (surgeries, cancer, or evacuation), while paying out-of-pocket or via Mutuelle for routine needs.

10. ISIC-Linked and Regional Brokers

Platforms like InternationalStudentInsurance.com and agents linked to the International Student Identity Card (ISIC) provide access to specialized group plans. These plans, such as “StudentSecure” or “Patriot Exchange,” often offer four levels of coverage (Basic, Smart, Select, Elite) to meet varying budget requirements. For families in Rwanda, these brokers are useful for comparing IMG and World Nomads plans side-by-side, ensuring that the selected policy meets the specific “Waiver” requirements of their host university.

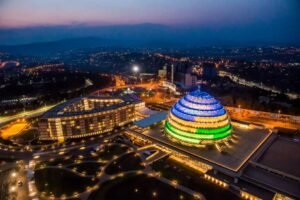

Clinical Excellence: The Private Hospital Infrastructure in Kigali

The utility of a million-dollar Cigna or Allianz policy in Rwanda is defined by its access to high-tier private facilities. Kigali is home to a concentrated medical hub that serves the broader East and Central African region.

King Faisal Hospital (KFH): Quaternary Leadership

King Faisal Hospital is the flagship of Rwandan healthcare, operating as a multi-specialty quaternary facility. For families, KFH is the only local choice for specialized pediatric surgery, cardiac surgery, and complex neurosurgery. In 2025, KFH inaugurated a new advanced modular heart surgery theatre and launched Rwanda’s first ketamine clinic, demonstrating a rapid adoption of modern medical protocols.44 KFH accepts almost all international insurance through direct billing, provided the insurer is in their network.

The Private Specialist Network

Beyond KFH, several private hospitals provide a more personalized, “boutique” medical experience that is highly compatible with international insurance.

| Facility Name | Specialized Care Areas | Accreditation/Status |

| Baho International Hospital | Neonatology, Maternal-Fetal Medicine, Perinatology | Private (100 beds) |

| Hôpital La Croix du Sud | Obstetrics, Gynecology, General Surgery | Private (Kigali) |

| LifeCare Kigali | General Practice, Specialist Consultations | Private Clinic |

| Kigali Adventist Dental | Orthodontics, Advanced Dental Surgery | Private (English Speaking) |

| Caraes Ndera | Mental Health, Neuropsychiatry | Specialized Private |

For international families, “Safety, Person-centeredness, and Timeliness” are the key metrics cited by the Ministry of Health’s HSSP V plan. Private hospitals in Kigali generally meet these metrics by offering a larger number of bilingual (English/French) physicians and faster access to high-level equipment than district public hospitals.

Catastrophic Risk: Medical Evacuation and Repatriation

For serious medical conditions that exceed the quaternary capabilities of King Faisal Hospital—such as certain advanced organ transplants or specialized neonatal emergencies—medical evacuation to Nairobi, South Africa, or the home country becomes necessary.

The Logistics of Aero-Medical Missions

AMREF Flying Doctors is the premier provider in the region, operating ICU-equipped air ambulances out of Nairobi. Their “Maisha” plan is a regional evacuation membership specifically for the EAC, providing air and ground transportation for individuals and families.

- Evacuation Cost: Without insurance, an air ambulance from Kigali to Nairobi can cost upwards of $20,000, while a long-range medevac to Europe can exceed $100,000.

- The “Flying Doctors” Advantage: AMREF membership is remarkably affordable, costing between $20 and $40 per person per year, a “must-have” for families living in Kigali.

Repatriation of Remains

In the tragic event of a death, the cost and logistics of repatriating remains from Rwanda to Europe or the USA are significant.

- Body Repatriation: Costs range from $10,000 to $20,000. This includes embalming ($500–$1,200), a hermetically sealed casket ($500–$3,000), and air freight fees calculated by weight and distance.

- Cremation Option: Shipping cremated remains is simpler and costs approximately $300 USD, though some European countries prohibit the mailing of ashes, necessitating specialized courier services like SpeedLink.

Navigating the “Maternity Trap”: A Critical Analysis for Families

Maternity care represents the most complex financial planning point for student families. The “Maternity Trap” refers to the intersection of long waiting periods and low benefit caps found in many standard international plans.

The Actuarial Logic of Waiting Periods

Insurers like Allianz, Cigna, and Prime Insurance apply waiting periods (10–12 months) to ensure that policyholders do not join a plan solely to cover an imminent birth.

- Cigna Gold/Platinum: 12-month waiting period for routine and complicated maternity.

- Prime ISONGA: 10-month waiting period from the effective date of membership.

- IMG Platinum: 10-month waiting period for maternity and newborn care.

Benefit Caps vs. Real Costs

While a $7,000 or $14,000 maternity limit (Cigna Gold/Platinum) might seem substantial, the costs of a complicated delivery involving prolonged NICU stays can quickly exceed these amounts. Families planning to have children in Rwanda are advised to prioritize plans that offer high “Maternity Complications” limits, such as the VUMI Global Flex, which provides up to $1,000,000 for life-threatening birth complications.

Financial Modeling: Risk-Adjusted Costs for a Family of Four

To understand the true cost of healthcare for a student family in Rwanda, one must consider the Expected Out-of-Pocket (EOOP) cost.

$$EOOP = \sum (P(Illness) \times (Cost_{treatment} \times Coinsurance)) + Premium$$

Where $Premium$ is the fixed cost, $P(Illness)$ is the probability of a medical event, and $Coinsurance$ is the percentage the family pays after the deductible is met.

Estimated Annual Family Premiums (2,000–5,000 USD Range)

| Plan Type | Annual Premium (Est. Family of 4) | Best Use Case |

| Local Hybrid (Mutuelle + ISONGA) | $400 – $800 | Budget families remaining in the EAC |

| Student Specialist (IMG SHA Platinum) | $1,800 – $2,500 | Young families requiring visa compliance |

| Mid-Tier Global (Cigna Silver) | $2,500 – $3,500 | Families seeking million-dollar limits (no maternity) |

| Comprehensive Global (Allianz Enhanced) | $4,000 – $6,000 | Families seeking high maternity and dental limits |

Practical Tips for Education Advisors and Families

- The Enrollment Timeline: For plans with 12-month waiting periods, families must enroll well before conception. If a student arrives in Rwanda in September 2025 and conceives in October, the July 2026 delivery will likely not be covered by a new international policy.

- Confirming “Dependent Extension”: Never assume a university plan covers a spouse. Institutions like UNILAK explicitly state that students are responsible for the costs of further medical treatment beyond campus emergencies, and families are not automatically included in the $80 mandatory fee.

- The “India Referral” Clause: For regional plans like Prime’s ISONGA, ensure the family understands the “strict referral basis” for treatment in India. Such treatments must be pre-authorized by the insurer to avoid a claim denial.

- Digital Document Management: Use apps like “Easy Claim” (APRIL) or “MyVUMI” to store digital insurance cards. In an emergency at King Faisal Hospital, having instant access to the policy number and the insurer’s 24/7 hotline can expedite the pre-authorization process for surgeries.

Strategic Conclusions on the 2025–2030 Outlook

The landscape of medical insurance for international student families in Rwanda is characterized by a high degree of fragmentation, necessitating a sophisticated, multi-layered approach to risk management. The mandatory foundation of Mutuelle de Santé ensures social and legal compliance, while university-led schemes provide a basic tier of campus-level safety. However, for the professional family, these are insufficient to cover the quaternary-level risks associated with specialized surgery or emergency medical evacuation to regional hubs like Nairobi.

The emergence of tailored regional products like Prime Insurance’s ISONGA and the price corrections seen in global players like Cigna for 2026 suggest a maturing market that is becoming more responsive to the needs of the “globally mobile” student. Families are best served by prioritizing plans that offer a “First-Dollar” coverage for routine outpatient care in Kigali’s private clinics, while maintaining high-limit catastrophic cover for inpatient care and aero-medical evacuation. As Rwanda continues to execute its HSSP V strategy, the integration of digital health tools and the expansion of private quaternary facilities will likely further bridge the gap between local health systems and international standards of care.

Reference:

- Mutuelle De Santé: Improving Access to Health Care in Rwanda – The Borgen Project, accessed January 17, 2026, https://borgenproject.org/mutuelle-de-sante/

- Rwanda Healthcare System & Medical Insurance Options for Expats, accessed January 17, 2026, https://expatfinancial.com/healthcare-information-by-region/african-healthcare-system/rwanda-healthcare-system/

- Health Services – Official Rwanda Development Board (RDB) Website, accessed January 17, 2026, https://rdb.rw/investment-opportunities/health-services/

- International Health Insurance for Expats in Rwanda – Pacific Prime, accessed January 17, 2026, https://www.pacificprime.com/country/africa/rwanda-health-insurance/

- How to Apply and Pay for Community Based Health Insurance (Mutuelle) – IremboGov, accessed January 17, 2026, https://support.irembo.gov.rw/en/support/solutions/articles/47001199252-how-to-apply-and-pay-for-community-based-health-insurance-mutuelle-

- Rwanda unveils fifth Health Sector Strategic Plan to advance universal health coverage, accessed January 17, 2026, https://rbc.gov.rw/wp/rwanda-unveils-fifth-health-sector-strategic-plan-to-advance-universal-health-coverage/

- Cost of an air ambulance to or from Rwanda: all you should know, accessed January 17, 2026, https://www.medical-air-service.com/cost-of-an-air-ambulance/rwanda_rw.html

- International Students – UNILAK, accessed January 17, 2026, https://site.unilak.ac.rw/international-students/

- MIS/UR – University of Rwanda, accessed January 17, 2026, https://mis.ur.ac.rw/

- HEALTH – UNILAK, accessed January 17, 2026, https://site.unilak.ac.rw/health/

- International Student Insurance – IMG Global, accessed January 17, 2026, https://www.imglobal.com/international-student-insurance

- Expat Student | APRIL International, accessed January 17, 2026, https://www.april-international.com/en/international-student-insurance/expat-student

- Access For Student | PDF – Scribd, accessed January 17, 2026, https://www.scribd.com/document/894894538/Access-for-student

- Are students required to have medical insurance? – Admissions Portal, accessed January 17, 2026, https://help.alueducation.com/support/solutions/articles/204000012976-are-students-required-to-have-medical-insurance-

- International Health Plans – Cigna Global, accessed January 17, 2026, https://www.cignaglobal.com/international-health-plans

- Human Resources – Human Resources – Carnegie Mellon University, accessed January 17, 2026, https://www.cmu.edu/hr/benefits/oe/plan-changes-international.html

- Cigna Global Health Insurance, accessed January 17, 2026, https://www.internationalinsurance.com/cigna/medical/

- Allianz Partners Launch a New Range of International Health Insurance Plans for Individual Customers and Their Families, accessed January 17, 2026, https://www.allianzcare.com/en/about-us/news/allianz-international-health-insurance-plans-update.html

- Allianz Care review 2025: complete guide for expats & digital nomads – Expatica, accessed January 17, 2026, https://www.expatica.com/global/healthcare/healthcare-basics/allianz-care-health-insurance-review-2173537/

- Global Health Insurance | Allianz Care Official Site, accessed January 17, 2026, https://www.allianzcare.com/en.html

- International Private Medical Insurance – Rwanda – Zamara, accessed January 17, 2026, https://zamaragroup.com/rw/our-solutions-rwanda/international-private-medical-insurance-rwanda/

- International Private Medical Insurance – DRC – Zamara, accessed January 17, 2026, https://zamaragroup.com/en/drc/our-solutions-drc/international-private-medical-insurance-drc/

- Zamara Afya policy – Rwanda, accessed January 17, 2026, https://zamaragroup.com/rw/our-solutions-rwanda/zamara-afya-policy-rwanda/

- COMPANY LOGO – prime.rw, accessed January 17, 2026, https://prime.rw/public/themes/files/prime_insurance/productContract/Isonga_New.pdf

- The 10 Best International Health Insurance Companies in 2025, accessed January 17, 2026, https://www.internationalinsurance.com/health/best-companies/

- IMG Student Health Advantage – International Citizens Insurance, accessed January 17, 2026, https://www.internationalinsurance.com/img/student-health-advantage/

- Student Health Advantage Travel Medical Insurance – IMG, accessed January 17, 2026, https://www.imglobal.com/travel-medical-insurance/student-health-advantage

- Student Health Overview – International Student Insurance, accessed January 17, 2026, https://www.internationalstudentinsurance.com/students/

- Top 10 Insurance Companies in Rwanda for Expats – Pacific Prime, accessed January 17, 2026, https://www.pacificprime.com/blog/top-rwanda-insurance-companies-expats.html

- April International Expat Insurance – Pacific Prime, accessed January 17, 2026, https://www.pacificprime.com/insurers-and-partners/april-international/

- International Health Insurance | APRIL International, accessed January 17, 2026, https://www.april-international.com/en

- Cheap Student Travel Insurance — Buy the Best Policy | Auras, accessed January 17, 2026, https://auras.insure/student-travel-insurance/

- Auras Insurance — Reliable Travel Insurance Company, accessed January 17, 2026, https://auras.insure/

- Kigali, Rwanda | Office of Global Health – Yale School of Medicine, accessed January 17, 2026, https://medicine.yale.edu/internal-medicine/global/sites/rwanda/

- SPECIALVIP PLUS – VUMI, accessed January 17, 2026, https://www.vumigroup.com/wp-content/uploads/2023/07/Plan-Overview-2023-Special-VIP-Plus-ENG.pdf

- Universal VIP – VUMI, accessed January 17, 2026, https://www.vumigroup.com/universal-vip/

- 2025-rwanda-benefits-guide.pdf – Carnegie Mellon University, accessed January 17, 2026, https://www.cmu.edu/hr/assets/benefits-international/2025-rwanda-benefits-guide.pdf

- AXA Health review: complete guide for expats & digital nomads – Expatica, accessed January 17, 2026, https://www.expatica.com/global/healthcare/healthcare-basics/axa-health-insurance-review-2173534/

- Compare International Health Insurance Plans from Now Health, accessed January 17, 2026, https://www.now-health.com/en/insurance-plans/

- VUMI Health Insurance – Global medical insurance – Tenzing Pacific Services, accessed January 17, 2026, https://ten-pac.com/vumi-health-insurance/

- Insurance for students with or without ISIC | ISIC.cz, accessed January 17, 2026, https://www.isic.cz/en/insurance

- Students – VISIT International Health Insurance, accessed January 17, 2026, https://www.visitinsurance.com/student

- Student Health and Travel Insurance – International Student Insurance, accessed January 17, 2026, https://www.internationalstudent.com/insurance/

- KING FAISAL HOSPITAL RWANDA – KFHR, accessed January 17, 2026, https://kfh.rw/

- FAQ – KING FAISAL HOSPITAL RWANDA, accessed January 17, 2026, https://kfh.rw/faq/

- Baho International Hospital Facility – VFMatch, accessed January 17, 2026, https://vfmatch.org/explore/facilities/5e5d9288af007f00828131d9

- Ethos Asset Management Inc., USA Announces Deal in Rwanda with Baho International Hospital Ltd, to Build Brand New Hospital Facilities and Equip Them in Kigali – Business Wire, accessed January 17, 2026, https://www.businesswire.com/news/home/20211105005591/en/Ethos-Asset-Management-Inc.-USA-Announces-Deal-in-Rwanda-with-Baho-International-Hospital-Ltd-to-Build-Brand-New-Hospital-Facilities-and-Equip-Them-in-Kigali

- Private hospitals – Military Medical Insurance, accessed January 17, 2026, https://www.mmi.gov.rw/partners/private-health-facilities/private-hospitals

- Best Specialist hospital in Kigali – AIM LifeCare (Multi Speciality) Clinic, accessed January 17, 2026, https://www.lifecare.rw/insurances

- Rwanda: medical facilities – GOV.UK, accessed January 17, 2026, https://www.gov.uk/government/publications/rwanda-list-of-medical-facilities/rwanda-list-of-medical-facilities

- Flying Doctors Kenya | East African Air Ambulance Service, accessed January 17, 2026, https://www.africakenyasafaris.com/the-flying-doctors-are-on-call/

- AMREF Flying Doctors – Air Ambulance Service in Africa (Flying Doctors), accessed January 17, 2026, https://flydoc.org/

- Costs to Return a Loved One: Understanding Dead Body Flight Expenses – Smart Cremation, accessed January 17, 2026, https://www.smartcremation.com/articles/dead-body-flight-cost/

- Body Repatriation Rwanda – Newrest Family Funerals, accessed January 17, 2026, https://newrestfunerals.co.uk/services/body-repatriation/africa/east-africa/body-repatriation-rwanda/

- How Much Does It Cost to Have a Loved One Returned to the US If They Pass Away Overseas? | Neptune Society, accessed January 17, 2026, https://neptunesociety.com/resources/cremation-planning/costs-to-return-loved-one

- USA to Europe Cremated Remains Courier Services – SpeedLink Repatriation, accessed January 17, 2026, https://www.speedlinkrepat.com/services/usa-to-europe-cremated-remains-courier-services/

- Cigna Global Health Options – International insurances for expats, emigrants and travelers worldwide, accessed January 17, 2026, https://www.expatinsurances.org/health-insurance/cigna-global-health-options/

- Review: Allianz Care for digital nomads, accessed January 17, 2026, https://nomads.insure/health/allianz-care-international/

- Student Health Advantage Platinum Group – American Visitor Insurance, accessed January 17, 2026, https://americanvisitorinsurance.com/img/student-health-advantage-platinum-group-student-insurance.asp

VUMI: Home, accessed January 17, 2026, https://www.vumigroup.com/