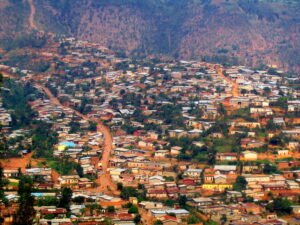

It is interesting to study in Rwanda.

You still must have a good plan in case you become sick or injured.

The health systems differ depending on the country.

In Rwanda, Kigali has good private care but some cases are complicated and therefore might need evacuation to Kenya or South Africa hence evacuation cover is necessary to students in this country.

Public Mutuelle de Santé (the community-based health insurance, or CBHI) is provided to residents based on a solidarity scheme.

Most international students instead depend on personal international health insurance since CBHI is not intended to be a temporary, portable student product but is only available to household members domestically and is run by the Rwanda Social Security Board.

Visa rules matter too.

Immigration rules in Rwanda permit the government to insist that a foreigner must present a health-insurance certificate, and universities may demand similar evidence when a person enrolls in a university–so bring it.

You will find trusted vendors, what to expect and a practical buying playbook below.

The idea is straightforward, find cover that works in Rwanda, fits institutional needs and shields your budget when you need it the most.

What “good coverage” looks like in Rwanda

Start with the basics.

Any international student plan that you shortlist must include:

Inpatient care, or outpatient care, in a private hospital or clinic. King Faisal Hospital is a major referral hospital in Kigali and receives foreign patients.

Owing to the possibility of complex cases requiring transfer to regional centres such as Nairobi or Johannesburg, emergency medical evacuation and repatriation.

24/7 service and pre-authorizing help to ensure that you get referred to the appropriate facility as quickly as possible.

Billing in network where possible to prevent huge upfront bills.

Telemedicine and mental-health insurance, which assists with minor diseases and continuous assistance during the time of studying in another country.

Check compliance next.

Your cover must meet the university regulations and should be acceptable to immigration in case of questioning; plan document or confirmation letter will help in this.

Finally, focus on clarity.

Understand the deductible, co-pay, pre-authorization requirements and waiting periods on pre-existing conditions or maternity.

Top health insurance options for overseas students in Rwanda

These providers are familiar to the universities and brokers and they produce explicit policy documents.

All of them provide international advantages that can suit an Rwandan-based student–compare fit, not logos.

1) Cigna Global

Loose and popular.

Cigna has student cover dedicated pages, has a large international network with direct-billing option and 24/7 multi-language support – helpful in East Africa and when travelling during holidays.

What is unique: Global telehealth, including modular plans, through the Cigna Wellbeing app, which can save unnecessary visits to the clinic due to minor issues.

2) AXA Global Healthcare

Large international presence and powerful online resources.

AXA is also planning Virtual Doctor teleconsultations and a Second Medical Opinion service, which is convenient when you want to confirm a treatment plan offered locally.

Why it works in Rwanda: you can see options without necessarily delaying care, and the evacuation and inpatient benefits AXA offers cover regional referrals when necessary.

3) Bupa Global

Platinum overseas medical insurance.

Bupa focuses on global provider networks, direct billing and full inpatient and outpatient benefits including expatriates and mobile students across the globe.

Best with students desiring increased limits and concierge service.

The trade-off is price.

4) Allianz Care

Relied upon by numerous organizations.

Allianz issues specific student plans international and has a reputation of good evacuation and emergency response-definitely important when complex treatment is to be sent overseas.

Universities are usually aware of the brand that can facilitate the paperwork.

Continue a comparison of limits and out-of-pocket rules.

5) VUMI

Expensive expatriate cover that has good evacuation terms.

VUMI strategizes its planners on top of quality networks and strong medical assistance- good in case you desire higher ceilings and maternity choices.

Get student qualifications on your specific plan.

VUMI is an expat school and not a student school.

6) International Student Insurance (ISI)

A developed student platform.

ISI has developed Student Secure range and the products of its partners to match the expectations of universities and visa requirements, providing clear plan documentation, online enrolment, telemedicine access during U.S. stays.

ISI is well-known because it is cost-controlled and convenient to buy.

Always ensure that your university minimums are compared to the certificate of the plan.

7) IMG (International Medical Group).

A few student options.

The IMG Student Health Advantage and Patriot Exchange plans release comprehensive brochures and offer the advantages of mental health, organized sports, and evacuation-in addition to the ease of enrolling.

IMG also emphasizes telehealth in most descriptions of the plan.

Wait times when checking pre-existing conditions on the version you choose.

8) APRIL International

Digital and student friendly.

APRIL demonstrates a bare-bones online application featuring immediate certificates and claims service to a very high number of students (the company named 500,000 or more students all over the world).

That immediate certificate may come in handy when doing university paperwork at the last moment.

Browse exclusions and any zone-based limits.

9) Britam Rwanda (local domestic medical insurance)

There is a local alternative to private care.

Britam Rwanda provides both inpatients and outpatient medical insurance with regional treatment coverage in East Africa and is able to coordinate road and air ambulance with partners- handy when students desire a partner with a Rwanda presence.

Critical caveat: benefits and provider networks are not the same as international health insurance, and you should ensure that Britam policy meets your university and immigration requirements, should you opt to use a local plan.

Ask to receive a written benefit summary and a letter of enrollment coverage.

10) Auras (travel loans, Rwanda site)

Travel insurance with rwanda web pages and fast online registration.

Auras offers travel medical insurance (with a separate student-travel section) that is valid all over the world, and comes with a 14-day money-back guarantee – not to replace the full student medical insurance.

When you intend to use travel insurance, check with your university whether it accepts it (not all universities with full-year studies do).

Take travel cover during weekends or during interterm periods.

What your plan must cover (and why)

- Hospitalization and operation in Kigali in the private facilities.

- King Faisal Hospital promotes emergency care and international-patient channels, and therefore your proposal should include private-hospital care and any pre-authorization measures.

- In-emergency medical evacuation and repatriation 24/7 coordinated.

- According to the UK government, there are limited facilities outside of Kigali and sometimes medical evacuation to Kenya or South Africa is required; don’t overlook this advantage.

- Outpatient/GP care and diagnostics as direct billed as much as possible.

- Large insurers advertise direct-billing networks; examples of this are Cigna and Bupa, which focus on international networks and cashless payments.

- Mental-health Medicaid and telemedicine.

- The Virtual Doctor and ISI/IMG student plan materials created by AXA illustrate the fact that remote care helps students see through disruption.

- Prescription medicine and emergency dentistry.

- Read the list of benefits and save the claims and prior-auth pages.

- Evidence of coverage letter which is satisfactory to your institution and as may be requested, immigration.

- According to Rwandan law the Directorate General of Immigration may demand a health-insurance certificate on entry or permit.

How to pick the right plan (step-by-step)

Step 1: Request your university to provide specific health-insurance requirements (limits, evacuation, direct-billing requirements, deductible caps).

Most schools have a one-page minimum standard–copy line by line and ask that it be written that your plan is acceptable.

Step 2: select your coverage area.

When travelling within the country or internationally (e.g. conferences or fieldwork), go to the country (non-U.S.) or African plus-region; some allow you to dial scope up or down. Zones/area options are both published by Cigna and Allianz.

Step 3: Select your deductible and out of pocket ceiling.

Take the maximum deductible that you can afford today without feeling stressed. Most students would like small deductibles to spend on new grounds to keep initial expenses low.

Step 4: Check partners in evacuation and authorization.

Inquire about how evacuations are instigated, the cities they usually evacuate out of Kigali, and whether the evacuation will be funded. The fact is emphasized by the UK FCDO note on regional evacuation.

Step 5: verify pre-existing-condition rules.

Most student plans include acute pre-existing conditions only after a waiting period on the higher levels, which IMG and other providers explain in brochures. Read the certificate and know what is in it.

Step 6: prepare your documents.

You will want the policy schedule, a coverage letter and claims/authorization contacts on your phone and printed in your passport sleeve.

A concise comparison snapshot

Use this table as a starting point.

It’s not exhaustive; it points you to the feature most relevant to Rwanda.

| Provider | Why students choose it | Helpful features for Rwanda |

| Cigna Global | Flexible student options + very large international network | Direct billing, global telehealth, documents tailored for enrollment. Cigna Global+1 |

| AXA Global Healthcare | Strong digital care and second opinions | Virtual Doctor 24/7; evacuation and inpatient support typical of IPMI plans. |

| Bupa Global | Premium coverage with concierge service | Wide provider access and cashless care where contracted. |

| Allianz Care | University-friendly brand and student plans | Clear certificates; robust assistance and evacuation services. April Assets |

| VUMI | High limits for expats | Emphasis on evacuation and comprehensive benefits; check student eligibility. AXA – Global Healthcare |

| International Student Insurance (ISI) | Student-specific plans and pricing | Student Secure, Visa/uni-ready docs, telemedicine for U.S. stays. |

| IMG | Multiple student tiers | Student Health Advantage / Patriot Exchange with mental health and sports coverage; detailed brochures. purchase.imglobal.comimglobal.com |

| APRIL International | Fast online enrollment and instant certificate | Practical when deadlines are tight; global student user base. lp.april-international.com |

| Britam Rwanda | Local private medical insurance | Inpatient/outpatient, regional treatment options, road/air ambulance—confirm school acceptance. rw.britam.com |

| Auras (Travel) | Quick, low-cost travel-medical for trips | Rwanda site, student-travel page; use for trips—not a full replacement for IPMI. auras.insure+1 |

Using your insurance in Rwanda: practical tips

Save key numbers.

The national emergency in Rwanda is 112; a toll-free line (3939) and an international one ( +250 788 123 200) are available at King Faisal Hospital. Add next to them the 24/7 assistance number of your insurer.

Locate your closest personal establishment.

King Faisal is the central referral hospital in Kigali; your insurer app will display contracted clinics where regular care can be received.

Telemedicine should be used at the beginning with minor problems.

Virtual Doctor, an example of one offered by AXA, can even tell you whether you should see the doctor in-person, and numerous student plans come with video visits.

Know the claims path.

Direct billing is not everywhere. Should you be paying out-of-pocket, make copies, hand them in, and fill out a claim form as soon as possible -local insurers such as Britam have instructions on making claims, and you can use this as a checklist to make sure you cover all the important points.

Make future plans other than in Rwanda.

Assuming you might be going to neighboring countries on fieldwork or short breaks, ensure those countries are covered by your area of cover and that you can still be evacuated.

About Rwanda’s CBHI (“Mutuelle de Santé”) and why students usually choose private insurance

Context makes you make good decisions.

Community-Based Health Insurance in Rwanda is a solidarity model in which families make contributions to obtain care; administration is at the Rwanda Social Security Board, and the emphasis is national access, not global portability.

The enrollment usually occurs at the national level by household.

Certain inclusion initiatives have been aided by UNHCR and RSSB in favor of refugees and refugee students, which highlights that CBHI is a national social-protection initiative with special eligibility, rather than a privatized international student strategy.

Instead you will typically need private insurance as a foreign student with no resident status.

In any case, consult your university admissions or international office to find out what kind of policy they will accept to register you.

Buying playbook: three clear scenarios

Scenario A: You desire the widest global medical plan.

Select a full international medical insurance (IPMI) plan with evacuation and mental-health benefits with Cigna, Bupa, AXA, Allianz, or VUMI; choose a deductible you can afford; include dental provision in case you are certain you will use it.

Scenario B: You are price-conscious but require compliance and quality customer service.

Compare student-specific levels at IMG and ISI; ensure that telemedicine, mental health, and evacuation are covered; verify the wait time when having a preexisting condition.

Scenario C: You are already covered by primary and require local add-ons.

Think of a local Britam policy in order to get private care in Rwanda, but call your university first, as not all schools are ready to get international benefits such as evacuation and repatriation.

Quick compliance notes

Big headaches are avoided through small details.

According to the immigration law in Rwanda a health-insurance certificate can be asked of a foreigner at entry or during permit processing; the universities are also allowed to establish their own minimums on insurance.

Your action item is simple.

Request your school to provide the written standard of insurance, and have your insurer write a letter that indicates that the plan meets those requirements (limits, evacuation, validity dates and your name/passport number).

Final checklist before you buy

- Area of cover includes Rwanda and your travel plans.

- Evacuation spelled out (who decides, to where, and return travel).

- Direct billing availability in Kigali and claims instructions for reimbursement.

- Telemedicine options and mental-health visit caps.

- Proof-of-insurance letter for visa/university files.

If one plan leaves too many blanks, move on.

There are enough solid choices that you shouldn’t have to compromise on core protections in Rwanda.

Sources

- UK Foreign, Commonwealth & Development Office (FCDO) travel health advice for Rwanda: notes on limited facilities and medical evacuation to Kenya/South Africa; emergency number 112.

- Rwanda Social Security Board (RSSB): CBHI (“Mutuelle de Santé”) overview and administration. rssb.rw+1

- Rwanda immigration law and guidance: potential requirement for a health-insurance certificate for foreigners. rwandalii.orgrac.co.rw

- Provider documentation: Cigna student and network pages; AXA Virtual Doctor & second medical opinion; Bupa Global international health insurance; Allianz Care student plans; VUMI international health insurance; ISI Student Secure; IMG Student Health Advantage & Patriot Exchange; APRIL International student page; Britam Rwanda medical plan; Auras Rwanda travel insurance. Cigna Global+1April AssetsAXA – Global Healthcarepurchase.imglobal.comimglobal.comlp.april-international.comrw.britam.comauras.insure

- Care on the ground: King Faisal Hospital—emergency services and international-patient info. KFH+1