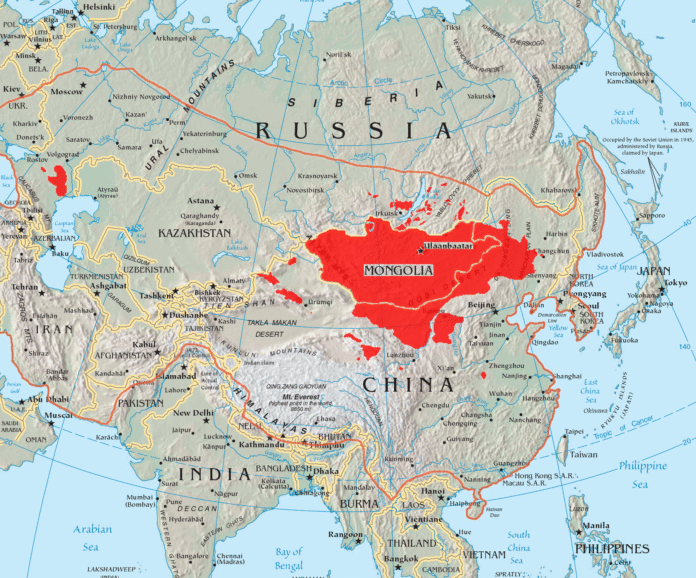

Studying in Nepal is unlike studying anywhere else. It’s a country of contrasts — breathtaking landscapes, ancient traditions, and vibrant culture, sitting right between the world’s two most populous nations. But while Nepal inspires the spirit, it also demands a practical mindset from anyone planning to live there for an extended period. Especially when it comes to health insurance.

For international students heading to Nepal, healthcare coverage works differently than in countries with centralized schemes like Malaysia’s EMGS or Australia’s OSHC. There is no mandatory government student insurance policy, and most institutions do not provide default coverage. In other words, you are responsible for ensuring that you have the right protection in place before arrival.

This may sound daunting, but it’s manageable — if you know what to look for. Let’s unpack what makes Nepal unique from a healthcare perspective, what your insurance plan must include, and which international providers are most trusted for coverage in the Himalayan region.

🏥 Why International Students in Nepal Need Comprehensive Coverage

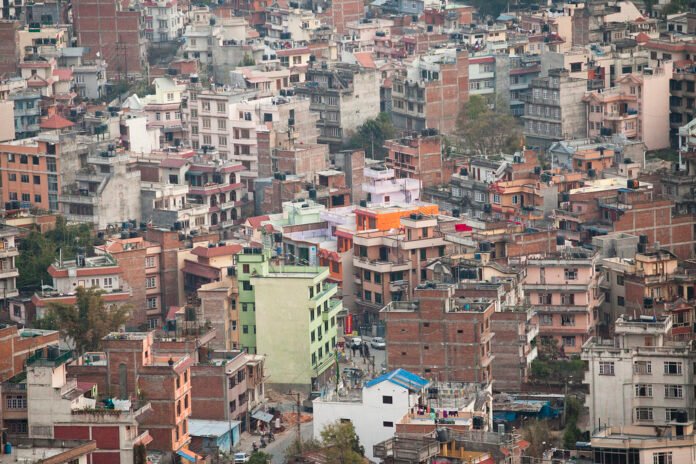

Unlike developed education destinations, Nepal’s healthcare infrastructure varies dramatically by location. In Kathmandu, private hospitals such as Norvic International Hospital, Grande International Hospital, and CIWEC Clinic offer relatively high-quality medical services that meet international standards. However, outside the capital, healthcare facilities are limited, often under-resourced, and lack advanced equipment.

That means if you fall ill or suffer an accident while studying in a rural area — say in Pokhara, Biratnagar, or near the Annapurna Circuit — you may need immediate medical evacuation to Kathmandu or even to another country such as India or Thailand.

And here’s the critical part: Evacuation is expensive. A helicopter rescue from a remote trekking area can easily cost $10,000 to $20,000 USD, while international medical flights cost far more. Without insurance, these expenses are entirely your responsibility.

This is why experts strongly recommend International Health Insurance (IHI) or a comprehensive travel medical plan with high financial limits and evacuation benefits. These plans not only cover hospital bills but also coordinate your evacuation and medical transfers — a lifesaver in emergency situations.

🎯 Top 10 Health Insurance Focus Areas for Students in Nepal

Since Nepal doesn’t have a regulated student insurance market, you’ll want to focus on internationally recognized providers that specialize in expatriate and student coverage. These plans are designed for global mobility — covering you in Nepal, your home country, and often worldwide.

Here are the top 10 providers and why they stand out.

🩺 1. Cigna Global

Why it works for Nepal:

Cigna Global’s plans are known for flexibility and scale. You can build your coverage like a puzzle — starting with a base plan and adding modules for outpatient care, vision, dental, and evacuation.

For students studying in Nepal, this customization is crucial. Private hospitals in Kathmandu can charge thousands for major procedures, and Cigna’s high annual limits (up to $8 million USD) ensure you’re never under-protected.

Actionable Tip: Choose a plan that includes “Worldwide excluding USA” to reduce costs but still cover evacuation to nearby hubs such as New Delhi or Bangkok.

🩺 2. Allianz Care

Why it works for Nepal:

Allianz Care has one of the most reliable global medical networks. Their student-friendly plans cover inpatient, outpatient, mental health, and, importantly, emergency evacuation and repatriation as standard.

Their multilingual 24/7 assistance service helps coordinate medical logistics — including helicopter evacuation if required. Allianz’s direct billing system in many Asian hospitals means you won’t need to pay upfront and wait for reimbursement.

Actionable Tip: Confirm with Allianz whether your plan includes air evacuation from mountainous regions, which is essential for students engaging in trekking or rural research.

🩺 3. AXA – Global Healthcare

Why it works for Nepal:

AXA’s tiered plans — Foundation, Standard, Comprehensive, and Prestige Plus — cater to a range of student budgets while maintaining core benefits like evacuation, cancer care, and mental health support.

Their virtual doctor service is another advantage for students living outside Kathmandu, allowing online consultations without the need to travel.

Actionable Tip: If you’ll be in rural areas, ensure your plan includes global evacuation coverage rather than “regional” — so you can be transferred to India or Thailand if required.

🩺 4. Bupa Global

Why it works for Nepal:

Bupa Global is a premium option for those seeking access to top private care and concierge-level assistance. They’re particularly strong in Asia, where their network extends to hospitals in India, Singapore, and Hong Kong.

Bupa’s inpatient benefits are virtually unlimited, and claims are processed quickly, which is critical during emergencies. While it’s a pricier choice, it provides unmatched peace of mind for postgraduate or research students.

Actionable Tip: Consider this option if your university or sponsor subsidizes health insurance costs.

🩺 5. IMG Global (Student Secure / Patriot Exchange)

Why it works for Nepal:

IMG has designed plans specifically for international students and exchange visitors. Their Student Secure and Patriot Exchange policies provide strong emergency medical and evacuation coverage at a reasonable price.

They also offer short-term and long-term versions, ideal for both semester-based and full-degree programs. With multilingual 24/7 assistance and digital claims, IMG is especially appealing for students managing finances independently.

Actionable Tip: Choose the Student Secure Elite or Select tier for comprehensive benefits, including repatriation and adventure sports coverage.

🩺 6. International Student Insurance (ISI)

Why it works for Nepal:

ISI specializes in student plans, offering flexible coverage levels — Budget, Select, and Elite — that all include emergency evacuation and repatriation.

Their plans are affordable and meet most university enrollment requirements worldwide. For students studying in smaller institutions or language centers in Nepal, ISI’s straightforward documentation and 24-hour support make it an excellent entry-level choice.

Actionable Tip: Always choose a plan that explicitly includes high-altitude evacuation if you’ll travel in mountainous areas.

🩺 7. GeoBlue (for U.S. Citizens)

Why it works for Nepal:

For American students, GeoBlue bridges the gap between U.S. insurance standards and global healthcare access. Their Navigator for Students plan provides extensive inpatient and outpatient coverage, alongside mental health and prescription benefits.

GeoBlue’s partnerships with Blue Cross Blue Shield allow smooth coordination if you return to the U.S. mid-program for care.

Actionable Tip: If you’re from the U.S., confirm that your policy includes direct billing at hospitals in India or Thailand, as these are common evacuation destinations for serious cases.

🩺 8. Now Health International

Why it works for Nepal:

Now Health offers a modern, digital-first approach. Their SimpleCare and WorldCare plans feature clear pricing, instant claims submission, and global evacuation coverage.

This provider is ideal for students who value clarity and simplicity. Their policies cover inpatient care in private hospitals and provide 24/7 multilingual support, which can make navigating emergencies in foreign healthcare systems far less stressful.

Actionable Tip: Keep a digital copy of your membership ID card — Now Health’s app can generate instant e-cards for admission in emergencies.

🩺 9. Travelex Insurance (Travel Select / Active Traveler)

Why it works for Nepal:

While primarily known for travel insurance, Travelex offers extended-stay policies that can function as affordable safety nets for students staying less than a year.

Their plans include emergency medical treatment, evacuation, and limited outpatient coverage. They are not substitutes for full IHI but can work for exchange programs or shorter academic visits.

Actionable Tip: Verify your university’s minimum insurance standards before relying on travel insurance for enrollment approval.

🩺 10. William Russell

Why it works for Nepal:

William Russell focuses on expatriate health coverage, emphasizing personalized service. Their policies are well-suited for students staying multiple years, offering high benefits for inpatient, outpatient, and emergency evacuation.

Their customer service is among the best in the market — you can actually speak with a representative rather than a call center script.

Actionable Tip: Opt for William Russell if you value direct, ongoing communication with your insurer and plan to remain in Nepal beyond one academic year.

🇳🇵 The Nepal-Specific Insurance Checklist: What You Must Secure

In Nepal, the quality of your insurance plan matters more than the provider’s name. The right plan ensures you get timely care even when the terrain, distance, or weather make access difficult. Here’s what to focus on before purchasing.

1. Robust Emergency Evacuation and Repatriation

Nepal’s landscape is majestic but treacherous. Helicopter rescues are routine, not rare.

Actionable Advice: Choose a policy with unlimited or $500,000+ evacuation coverage that explicitly includes helicopter transport from remote areas. Check that it covers both ground and air transfers to Kathmandu or regional hubs like Delhi and Bangkok.

2. High Maximum Coverage Limit

Even in Nepal, quality healthcare isn’t cheap — particularly in private hospitals that cater to foreigners.

Actionable Advice: Select a plan with a minimum annual limit of $250,000 USD. Ideally, opt for $1 million or higher to ensure full protection for extended hospitalization or surgical procedures.

3. Inpatient Care and Hospitalization

Hospital stays are the most financially draining.

Actionable Advice: Ensure your policy covers 100% of inpatient costs, including surgery, anesthetics, physician fees, and ICU care. Plans with cashless admission arrangements in Kathmandu hospitals are particularly valuable.

4. Outpatient and Specialist Benefits

Routine illnesses or infections are common when adjusting to Nepal’s climate or food.

Actionable Advice: Choose a plan that covers doctor visits, prescriptions, and diagnostics with low co-pays or deductibles. A strong outpatient module makes everyday healthcare accessible and stress-free.

5. Coverage in Your Home Country

Sometimes treatment or recovery is best handled back home.

Actionable Advice: Verify that your plan allows incidental visits or repatriation for long-term care. Some providers, like Cigna and Allianz, automatically include this flexibility.

6. Traveler’s and Adventure Risk Protection

Many international students explore Nepal’s natural beauty — hiking, rafting, paragliding. These are exhilarating but risky.

Actionable Advice: Add optional adventure sports coverage or confirm your policy doesn’t exclude trekking or high-altitude activities. Plans like IMG’s Patriot Exchange or ISI’s Elite tier often include these benefits.

🧭 Enrollment Guidance for Students

Insurance may not be required for a student visa, but most universities in Nepal expect proof of coverage before enrollment. Follow these steps for a smooth process:

- Check University Requirements:

Contact your university’s international office to confirm whether they have recommended insurers or specific minimum coverage (e.g., evacuation limit, hospitalization coverage). - Purchase Before Travel:

Secure your policy before departure. Many embassies and universities request the certificate of insurance during visa processing or registration. - Carry Proof Everywhere:

Keep both a printed and digital copy of your insurance card. In emergencies, this speeds up hospital admission and reduces confusion. - Update Your Contact Details:

Once you arrive, inform your insurer of your local address and emergency contact in Nepal for faster coordination if evacuation is required.

🌿Pro Tips:

Nepal’s beauty is vast, but so are its logistical challenges. The same terrain that attracts trekkers and adventurers can become a serious obstacle in a medical emergency. That’s why international students must think beyond basic travel insurance and invest in high-limit, evacuation-ready health coverage.

If you want maximum flexibility and reliability, Cigna Global, Allianz Care, and AXA Global Healthcare stand out as top-tier choices.

For affordability with solid protection, IMG Global or International Student Insurance are excellent mid-range alternatives.

Above all, remember this: in Nepal, insurance isn’t a formality. It’s your safety net, your evacuation plan, and your guarantee that help will come — even from the side of a mountain.

📚 References:

- Allianz Care. (n.d.). International student health insurance. Allianz Partners. Retrieved October 23, 2025, from https://www.allianzcare.com/en/personal-international-health-insurance/who-we-help/students.html

- AXA Global Healthcare. (n.d.). International health insurance for expats and students. AXA Group. Retrieved October 23, 2025, from https://www.axaglobalhealthcare.com/

- Bupa Global. (n.d.). International health insurance plans. Bupa. Retrieved October 23, 2025, from https://www.bupaglobal.com/en/international-health-insurance

- Cigna Global. (n.d.). International student health insurance. Cigna Healthcare. Retrieved October 23, 2025, from https://www.cignaglobal.com/students

- GeoBlue. (n.d.). Navigator health plans for students and faculty abroad. GeoBlue International. Retrieved October 23, 2025, from https://www.geobluetravelinsurance.com/

- IMG Global. (n.d.). Student Health Advantage – Travel medical insurance for students abroad. International Medical Group. Retrieved October 23, 2025, from https://www.imglobal.com/travel-medical-insurance/student-health-advantage

- International Student Insurance (ISI). (n.d.). Student Secure health insurance plans. InternationalStudentInsurance.com. Retrieved October 23, 2025, from https://www.internationalstudentinsurance.com/

- Now Health International. (n.d.). Global health insurance – SimpleCare and WorldCare plans. Now Health International Group. Retrieved October 23, 2025, from https://www.now-health.com/

- Travelex Insurance Services. (n.d.). Travel Select and Active Traveler plans. Travelex Insurance Services Inc. Retrieved October 23, 2025, from https://www.travelexinsurance.com/

- William Russell. (n.d.). International health insurance for students. William Russell Ltd. Retrieved October 23, 2025, from https://www.william-russell.com/international-health-insurance/who-we-cover/students/

- Norvic International Hospital. (n.d.). About us. Norvic International Hospital. Retrieved October 23, 2025, from https://www.norvichospital.com/

- Grande International Hospital. (n.d.). Grande International Hospital, Kathmandu. Grande International Hospital Pvt. Ltd. Retrieved October 23, 2025, from https://www.grandehospital.com/

- CIWEC Clinic Travel Medicine Center. (n.d.). About CIWEC Hospital Kathmandu. CIWEC Hospital Pvt. Ltd. Retrieved October 23, 2025, from https://www.ciwec-clinic.com/

- World Health Organization (WHO). (2023). Health system review: Nepal. WHO Regional Office for South-East Asia. https://www.who.int/nepal