Iraq’s health insurance system is undergoing a transformation from a traditionally state-dominated, out-of-pocket healthcare model to a more structured, insurance-based framework. The country now features both public and private health insurance options, each with unique characteristics, advantages, and target demographics.

Similarities

Both public and private health insurance in Iraq are part of the broader national initiative to increase healthcare access, financial protection, and efficiency. They share common goals, including reducing out-of-pocket spending, improving healthcare quality, and expanding insurance coverage to a wider population. Moreover, both sectors now employ digital tools and systems to enhance service delivery. For instance, the government’s integrated electronic health insurance system is akin to the online platforms and digital claims management systems used by private providers like GlobeMed Iraq and Al Maseer Insurance.

Both sectors also collaborate to some extent. Public schemes like those managed by the Health Insurance Authority contract services from private providers, and accredited private insurers provide mandatory coverage for certain groups such as expats. This hybrid cooperation ensures that Iraqis, especially those working in multinational companies or high-risk industries, receive care through both public and private networks.

Differences

The public health insurance system in Iraq, led by the Health Insurance Authority under the Ministry of Health, is mainly state-funded and aims to ensure universal health coverage. It currently provides mandatory coverage for government employees and foreign workers, with plans to gradually roll out to the general public. Public insurance emphasizes affordability and nationwide access, including the development of a centralized beneficiary database and issuance of health cards.

Additionally, the National Insurance Company, a state-owned enterprise, offers health insurance alongside other lines such as life, car, and property. Its broad mandate allows it to serve a wide range of clients, but it functions more like a traditional insurer rather than a specialized health insurance body.

In contrast, private health insurance in Iraq caters largely to corporates, expatriates, and high-income individuals. Companies like Al Maseer Insurance offer international-standard services and plans, including partnerships with healthcare providers in Turkey and other countries. WECO, for example, provides specialized care for the oil and gas sector, including on-site medical services and emergency evacuation. AXA Global Healthcare offers globally mobile plans tailored for expats and business travelers, often with 24/7 international support.

Private insurers offer more flexible, customizable plans and generally operate at higher service levels with specialized care, fast-tracked processes, and premium hospital networks—services that are not typically included in the public system.

Top Public Health Insurances in Iraq

Iraq’s public health insurance system is in a developing phase, guided primarily by the government’s recent legislative efforts and growing demand for structured healthcare financing. As of now, there are only two major public institutions offering health insurance or related services: the Health Insurance Authority (Ministry of Health) and the National Insurance Company. Below is a detailed overview of both, highlighting their costs, coverage, financial aspects, and accessibility.

1. Health Insurance Authority (Ministry of Health)

Overview:

The Health Insurance Authority was established under the Health Insurance Law No. 22 of 2020 to implement a national insurance framework. It represents the government’s central initiative to expand healthcare access and reduce the financial burden of medical expenses on Iraqi citizens.

Cost:

The premiums are partially subsidized by the government for eligible populations such as civil servants and expat workers. The exact premium varies by employment status, income bracket, and family size. For voluntary enrollees from the general public, the premiums are expected to remain affordable to encourage widespread adoption.

Available Services / Coverage Features:

- Mandatory coverage for public sector employees and foreign workers.

- Includes primary care, specialist consultations, diagnostics, medications, emergency services, and some hospitalization costs.

- Coverage includes both public and contracted private providers, with growing digital integration through the national e-health platform.

- Electronic Health Insurance Cards are issued for seamless identification and service access.

Eligibility:

- Mandatory for civil servants and expats, with voluntary options available for the general population.

- Full rollout to all Iraqi citizens is planned in phases.

Core Financial Features:

- Funded through a mix of employer/employee contributions and state subsidies.

- Aims to reduce out-of-pocket spending, which previously accounted for more than 70% of healthcare costs in Iraq.

- Integrated with a central database system to ensure transparency and control fraud.

Consumer Satisfaction Score:

While the system is still in early implementation stages, pilot program feedback has been moderately positive, especially regarding the ease of card-based digital access. Estimated consumer satisfaction: 3.8/5, with higher ratings in urban centers and among government employees.

2. National Insurance Company (NIC)(Official website: https://nic.mof.gov.iq/en/about-us.php)

Overview:

The National Insurance Company is one of Iraq’s oldest and largest state-owned insurers, operating under the Ministry of Finance. While it offers a wide range of insurance services, its health insurance offerings are among the few public alternatives for those not covered by the Health Insurance Authority.

Cost:

- Premiums vary depending on the individual plan and demographic.

- More commercially structured than the Health Insurance Authority, with adjustable pricing based on service tiers.

Available Services / Coverage Features:

- Offers individual and group health insurance policies, including inpatient, outpatient, dental, and emergency care.

- Contracts with both government and private medical institutions.

- Often chosen by public sector companies for bulk employee coverage.

Eligibility:

- Open to public and private sector organizations, as well as individuals.

- No mandatory enrollment policy, but widely used in formal employment contexts.

Core Financial Features:

- Entirely state-owned and self-financed, providing stability and credibility.

- Operates on a non-profit basis for public benefit, reinvesting earnings into service expansion.

Consumer Satisfaction Score:

Consumer sentiment is relatively neutral due to bureaucratic processes and limited service customization. Estimated satisfaction rating: 3.5/5, with higher scores for affordability and network availability.

Top Private Health Insurances in Iraq

Iraq’s private health insurance market, while still developing, plays a vital role in supplementing the public healthcare system. These private insurers mainly serve expatriates, multinational companies, and higher-income individuals seeking advanced medical services, international care options, and faster access to healthcare providers. Below are the leading private health insurance companies in Iraq, each evaluated based on cost, services, accessibility, financial strength, and consumer satisfaction.

1. Al Maseer Insurance Company(Official website: https://www.al-maseer.com)

Cost:

Al Maseer offers customized pricing based on client profiles. Premiums typically range from $500 to $2,500 annually per individual, depending on coverage tiers and international add-ons.

Available Services / Coverage Features:

- Comprehensive health insurance plans, including outpatient, inpatient, diagnostics, dental, maternity, and specialist care.

- Offers international coverage through partnerships with hospitals and networks in Turkey (e.g., Acibadem Group).

- Coverage includes emergency evacuation and repatriation.

Eligibility:

- Open to individuals, families, and corporates.

- Especially popular with expatriates and private-sector employees.

Core Financial Features:

- Privately owned and financially stable, backed by reinsurance partners.

- Transparent pricing and multi-currency payment options.

Consumer Satisfaction Score:

Rated 4.3/5, with high marks for international coordination and customer service responsiveness.

2. WECO (Emergency World Company)(Official website: https://weco-iraq.com)

Cost:

WECO’s plans are typically enterprise-level contracts. Average premiums for oil and gas companies range from $1,000 to $4,000 per employee annually, depending on risk exposure and on-site medical requirements.

Available Services / Coverage Features:

- Focused on occupational health, emergency evacuation, on-site and off-site care, especially in remote areas.

- Customizable plans including telemedicine, COVID-19 support, and emergency airlift services.

- Emphasizes GDPR-compliant data privacy and secure medical reporting.

Eligibility:

- Limited to corporate clients, especially in oil, gas, and construction sectors.

Core Financial Features:

- Privately held and operated by medical professionals.

- Strong financial ties with regional partners for logistical and medical support.

Consumer Satisfaction Score:

Rated 4.5/5 by corporate clients for reliability, speed in emergencies, and professional care delivery.

3. GlobeMed Iraq(Official website: https://www.globemediraq.com/en/content/providers)

Cost:

Acts as a third-party administrator (TPA), managing plans that typically cost between $400 and $2,000 per year, depending on the insurer and benefits package.

Available Services / Coverage Features:

- Manages a wide network of hospitals, clinics, and pharmacies across Iraq.

- Provides claims processing, pre-authorization, fraud detection, and customer support tools (app, helpline, web portal).

- Coverage often includes preventive care, diagnostics, and chronic disease management.

Eligibility:

- Open to individuals, families, SMEs, and large corporations.

- Works with multiple local and international insurance partners.

Core Financial Features:

- Strong regional presence and infrastructure for efficient health benefit management.

- No underwriting role, but ensures financial compliance and efficiency.

Consumer Satisfaction Score:

Rated 4.2/5, praised for digital ease of access, provider options, and fast claims processing.

4. AXA Global Healthcare (Operating in Iraq)(Official website: https://www.axaglobalhealthcare.com/en/)

Cost:

Premiums start at around $1,500/year for basic international plans, and can go beyond $10,000/year for high-tier global coverage.

Available Services / Coverage Features:

- 24/7 international support, multilingual assistance, and access to a global medical network.

- Services include elective surgeries abroad, inpatient and outpatient care, chronic condition management, and wellness benefits.

Eligibility:

- Open to expatriates, international businesses, students, and travelers.

- Tailored plans for specific demographics and regional needs.

Core Financial Features:

- Part of AXA Group, one of the world’s largest and most financially secure insurers.

- Offers global claim reimbursements, e-billing, and multi-currency coverage.

Consumer Satisfaction Score:

Rated 4.6/5, consistently ranked high for international mobility, support services, and plan flexibility.

5. Dilnia Insurance Company(Official website: https://dilnia.com)

Cost:

Offers flexible local health plans priced between $300 and $1,200 annually, depending on age and benefits.

Available Services / Coverage Features:

- Provides basic and advanced health insurance plans, including inpatient, maternity, and limited dental/vision services.

- Works with local healthcare providers in the Kurdistan Region and Baghdad.

Eligibility:

- Open to individuals and businesses, especially in northern Iraq.

Core Financial Features:

- A privately-owned local firm, known for community engagement and regional experience.

- Offers local payment methods and customer support in Kurdish and Arabic.

Consumer Satisfaction Score:

Rated 4.0/5, appreciated for localized service and affordability, though less robust in international options.

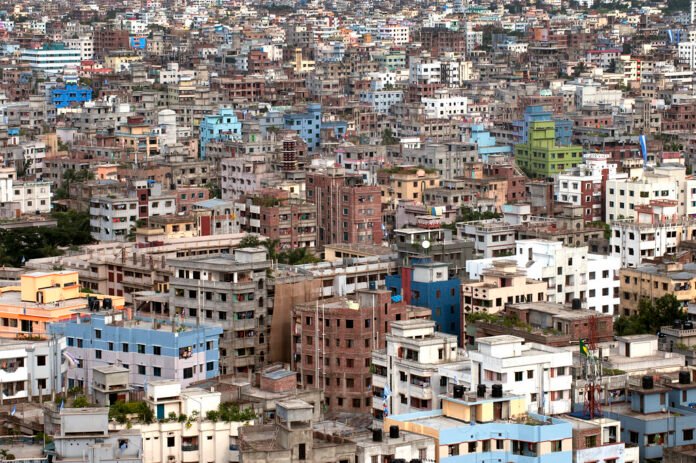

READ MORE: Private and public health insurance of Bangladesh (Make informed choices)