Kyrgyzstan’s health insurance consists of a mandatory public system and an expanding private sector. Both aim to enhance healthcare access for citizens, residents, and expatriates. However, they vary in funding, coverage, quality, and accessibility.

Key Differences

1. Administration and Structure

The Mandatory Health Insurance Fund (MHIF), under the Ministry of Health, oversees the public health insurance system. This system operates as a single-payer, state-managed program, offering a State Guaranteed Benefits Package (SGBP). It ensures primary, outpatient, and inpatient care for citizens and registered residents.

Private health insurance is run by companies like Zdorovye CJSC, ATN-Polis, and Jubilee Kyrgyzstan. They provide voluntary plans designed for wealthy individuals, businesses, and expatriates.

2. Funding and Cost

The public system is financed by employer contributions (2% of wages) and taxes. The state budget covers vulnerable groups like pensioners, students, and children. Uninsured adults must buy a mandatory certificate for 1,722 KGS annually.

Private health insurance costs depend on the provider, plan, age, and coverage level. Payments are made by individuals or through employer group plans.

3. Service Quality and Access

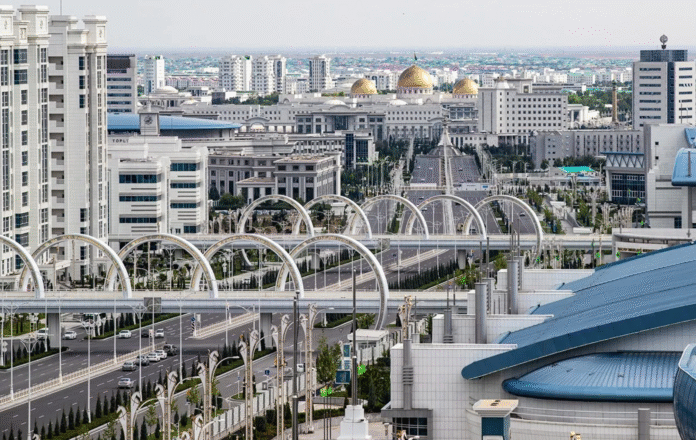

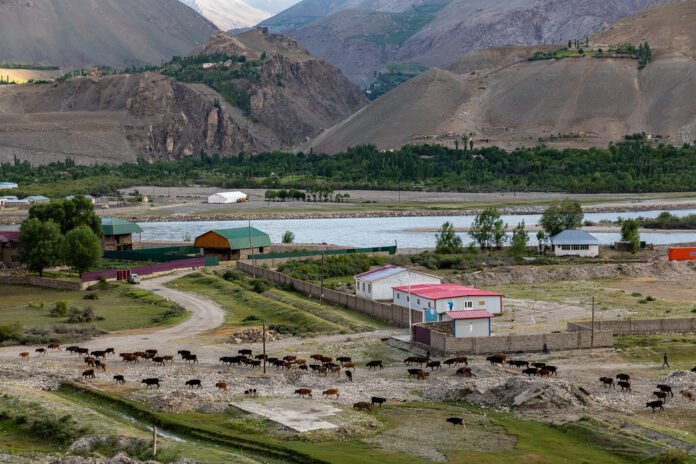

Public insurance offers essential healthcare but often faces overcrowding, resource shortages, and long waits, particularly in rural areas. Private insurance grants access to advanced clinics, faster service, specialist care, and sometimes international coverage, notably in Bishkek. It usually features superior facilities, direct billing, and more efficient services.

4. Eligibility and Coverage for Foreigners

Foreign citizens and students must purchase mandatory health insurance, as they are not automatically covered by the public system. Private and international insurers like Cigna, AXA, and Allianz provide tailored plans for expats and tourists, offering extensive international coverage, emergency evacuation, and round-the-clock multilingual support.

Key Similarities

Despite the structural divide, there are shared goals and overlapping features:

- Health Access Expansion:Public and private healthcare systems strive to enhance service access and lower financial obstacles.

- Use of Co-payments: Public systems may charge co-payments for non-essential services or brand-name drugs. Private insurers often have deductibles or coverage limits.

- Coverage of Common Services: Both systems provide essential medical services, like outpatient and inpatient care, but vary in coverage depth and quality.

- Reform and Modernization Focus: Both sectors are reforming policies to enhance quality, expand digital systems, and integrate financing models. Government reforms for MHIF align with private sector investments in technology and customer service.

Top Public Health Insurance in Kyrgyzstan: A Comprehensive Analysis

Kyrgyzstan has one national public health insurance system, run by the Mandatory Health Insurance Fund (MHIF). This centralized system guarantees healthcare access for all citizens and eligible residents under unified guidelines and benefits. Although it’s a single system, it uses various funding methods and coverage categories, making it diverse in practice. Here’s a summary of Kyrgyzstan’s public health insurance: its cost, services, accessibility, financial structure, and public satisfaction.

1. Mandatory Health Insurance Fund (MHIF)(Official website: http://foms.kg/ )

- Administrator:

- MHIF under the Ministry of Health of the Kyrgyz Republic

- MHIF under the Ministry of Health of the Kyrgyz Republic

- Open For:

- All citizens and permanent residents (compulsory)

- Foreign students, workers, and residents (must buy an insurance certificate)

- Socially vulnerable groups (pensioners, children, students under 21, people with disabilities, unemployed registered with labor offices, conscripts) — state pays on their behalf

- All citizens and permanent residents (compulsory)

Cost and Contributions

- Employees: Employers pay 2% of gross wages to the Social Fund, which allocates a portion to MHIF.

- Farmers/Entrepreneurs: Pay indirectly through patents and licensing fees, which include health insurance contributions.

- Uninsured Adults: Must purchase a Mandatory Medical Insurance Certificate for 1,722 KGS per year (approx. USD 20)[3].

- Foreigners: Required to buy the same certificate unless covered by an employer or institution.

Available Services and Coverage Features

The MHIF provides access to a State Guaranteed Benefits Package (SGBP) that includes:

- Primary care services (e.g., general physician visits, maternal care, child wellness)

- Outpatient specialist consultations

- Inpatient hospitalization and surgical services

- Emergency care

- Access to essential medicines (free or discounted under specific conditions)

- Vaccinations and preventive screenings

- Referral services for advanced care

Some services (e.g., dental, plastic surgery, brand-name medicines) may require co-payments or are not fully covered.

Core Financial Features

- Single-payer model: Funds pooled nationally and distributed to contracted healthcare providers.

- Consolidated budgeting: Ensures predictable financing and efficiency.

- Risk sharing: Contributions and government subsidies help reduce the cost burden on low-income and vulnerable groups.

- Certificate system: Provides access for uninsured individuals and foreigners, enhancing system inclusivity.

- Budget oversight: Regular audits and performance reviews by the MHIF Board.

Consumer Satisfaction Score

No official satisfaction index is published yearly, but surveys, World Bank reports, and local feedback indicate moderate consumer satisfaction, particularly for basic and emergency services.:

- Strengths:

- Universal enrollment and affordability

- Free access to key primary and secondary care

- Widespread geographic coverage

- Universal enrollment and affordability

- Challenges:

- Long wait times, especially for specialists

- Limited infrastructure and staffing in rural areas

- Out-of-pocket costs for non-covered medicines and services

- Long wait times, especially for specialists

On average, the consumer satisfaction score ranges between 60–70%, with better ratings in urban centers like Bishkek and Osh.

Top 5 Private Health Insurance Providers in Kyrgyzstan: Detailed Overview

Kyrgyzstan’s public health insurance is centralized, but private insurance is expanding, serving individuals, businesses, and expatriates who want better healthcare, quicker service, and superior facilities, particularly in cities like Bishkek. Here, we explore the leading five private health insurers, focusing on their pricing, coverage, financial stability, and customer satisfaction.

1. Zdorovye CJSC Insurance Company(Official website: http://www.insurance.kg/companies/zdorovie )

- Cost:

- Premiums vary by plan and age group; standard individual plans start from 10,000 to 25,000 KGS/year (approx. USD 110–280).

- Premiums vary by plan and age group; standard individual plans start from 10,000 to 25,000 KGS/year (approx. USD 110–280).

- Available Services:

- Outpatient consultations

- Hospitalization and surgical procedures

- Emergency services

- Basic diagnostics and lab work

- Outpatient consultations

- Open For:

- Individuals, SMEs, and corporate clients

- Individuals, SMEs, and corporate clients

- Core Financial Features:

- Largest private insurer by personal health premiums (81.4 million KGS in 2021)[4]

- Sustainable financial growth, solid reserves

- Largest private insurer by personal health premiums (81.4 million KGS in 2021)[4]

- Consumer Satisfaction Score:

- 75–78% – Reliable claims processing and broad coverage praised, though some delays reported in reimbursement for outpatient services.

2. ATN-Polis CJSC Insurance Company(Official website: https://atnpolis.kg/ )

- Cost:

- Individual policies begin around 9,000 KGS/year and increase with add-ons. Corporate premiums are customized.

- Individual policies begin around 9,000 KGS/year and increase with add-ons. Corporate premiums are customized.

- Available Services:

- Outpatient and inpatient care

- Diagnostic testing

- Ambulance transport

- Corporate health packages

- Outpatient and inpatient care

- Open For:

- Individuals and large business clients

- Individuals and large business clients

- Core Financial Features:

- Second-largest health insurer by premiums (43.2 million KGS in 2021)[4]

- Noted for high claims-to-premium ratio, indicating strong benefit utilization

- Second-largest health insurer by premiums (43.2 million KGS in 2021)[4]

- Consumer Satisfaction Score:

- 72–76% – Appreciated for corporate coverage, though some users cited limited hospital networks outside Bishkek.

3. Jubilee Kyrgyzstan Insurance Company(Official website: https://jubileeinsurance.kg/ )

- Cost:

- Premiums range from 12,000 to 35,000 KGS/year depending on age, plan type, and add-ons

- Premiums range from 12,000 to 35,000 KGS/year depending on age, plan type, and add-ons

- Available Services:

- Comprehensive medical coverage

- Inpatient, outpatient, pharmacy reimbursement

- Family and maternity plans

- Comprehensive medical coverage

- Open For:

- Individuals, families, and corporate clients

- Individuals, families, and corporate clients

- Core Financial Features:

- Backed by KICB (Kyrgyz Investment and Credit Bank)

- Broadest plan flexibility among local insurers

- Backed by KICB (Kyrgyz Investment and Credit Bank)

- Consumer Satisfaction Score:

- 78–82% – Highly rated for customer service and customizable plans, especially for middle- to high-income groups.

4. NSK CJSC Insurance Company(Official website: https://nsk.kg/ )

- Cost:

- Mid-tier plans begin at 11,000 KGS/year; premium coverage can go higher with specialized services

- Mid-tier plans begin at 11,000 KGS/year; premium coverage can go higher with specialized services

- Available Services:

- General outpatient and inpatient care

- Lab testing and emergency services

- Optional dental and chronic condition management

- General outpatient and inpatient care

- Open For:

- Individuals and families

- Individuals and families

- Core Financial Features:

- Ranked among top 5 insurers by premium and claims volume

- Strong reserve coverage and stable growth trends

- Ranked among top 5 insurers by premium and claims volume

- Consumer Satisfaction Score:

- 70–75% – Noted for transparent pricing and easy-to-understand policies.

5. A PLUS CJSC Insurance Company(Official website: https://www.aplus.kg/ )

- Cost:

- Basic coverage starts at 8,000 KGS/year; more advanced plans available for up to 30,000 KGS/year

- Basic coverage starts at 8,000 KGS/year; more advanced plans available for up to 30,000 KGS/year

- Available Services:

- Inpatient and outpatient medical care

- Day-care surgery and diagnostic services

- Preventive check-ups and wellness add-ons

- Inpatient and outpatient medical care

- Open For:

- Individuals and businesses

- Individuals and businesses

- Core Financial Features:

- Known for high claims payout ratios

- Growing client base with expanding service offerings

- Known for high claims payout ratios

- Consumer Satisfaction Score:

- 73–77% – Valued for accessibility and relatively fast claims processing in private clinics.

READ MORE: Private and public health insurance of Kazakhstán (Make informed choices)